In the past two years, hundreds of school districts in Washington state have responded to budget cuts and rising costs by firing thousands of teachers. This has caused an increase in class sizes which combined with WOKE propaganda and a huge increase in chronic absenteeism has lead to a decrease in student achievement on national tests. Due to the McCleary funding scam, school funding is likely to continue to fall in coming years, leading to thousands of additional teachers being fired despite the fact that property taxes have skyrocketed by over 60% in both King and Snohomish Counties since the McCleary school funding scam took effect. Thus, the problem of high class sizes will continue to get worse until the underlying causes creating this problem are addressed.

Washington voters have twice passed initiatives by wide margins to lower class sizes. However, both initiatives were toothless because they did not address how to get the funding needed to lower class sizes. Even the McCleary school funding scam, which provided billions of dollars in additional revenue for schools did not reduce class sizes because nearly 100% of the additional funds went to increasing teacher salaries.

Given our high tax rates, Washington families should have the best funded schools and lowest class sizes in the nation. Instead, Washington's one million children are forced to endure the highest class sizes in the nation. How can this be? The answer is that the Washington state legislature is robbing our schools of billions of dollars and robbing our children of their future in order to line the pockets of a few billionaires and wealthy multinational corporations. In this report, we explain how to reduce class sizes in Washington state down to the national average without increasing taxes simply by eliminating unconstitutional corporate tax breaks.

Why Small Class Sizes are Important

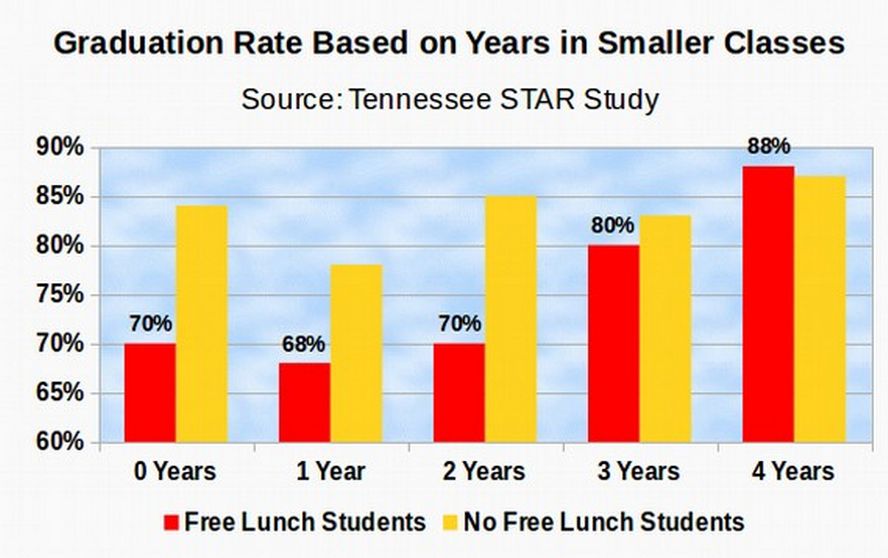

Small class sizes matter to the future of our students because small class sizes allow struggling students to get the help they need to succeed in school and succeed in life. For example, the nation's largest study on class sizes found thatlow income students who were lucky enough to have four full years of smaller classes were much more likely to graduate than their peers who had years in smaller class sizes:

Source: Finn, J. D., et. al. (2005). Small Classes in the Early Grades, Academic Achievement, and Graduating From High School. Journal of Educational Psychology.

http://www.classsizematters.org/wp-content/uploads/2012/10/Small-Classes-in-the-Early-Grades-Academic-Achievement-and-Graduating-From-High-School.pdf

A 2011 study, summarizing the life academic and economic outcomes of students in smaller classes in the STAR study compared to their peers who had normal class sizes, found that “The effects of class quality fade out on test scores in later grades but gains in non-cognitive measures persist.”

Put in plain English, high stakes test scores are not an accurate predictor of future student performance. However, student engagement from small class sizes is predictive of future success as an adult.

Here are just some of the adult outcomes for these students 20 years later of being in a smaller class in elementary school: Students were significantly more likely to graduate from high school, attend college, start a savings account, buy a home, get married and stay married. Students were less likely to commit a crime or go to prison. Much of this information was obtained from federal tax returns of 95% of the nearly 12,000 students involved in the STAR study.

Source: Chetty, R., Friedman, J.N., Hilger, N., Saez, E., Schanzenbach, D.W., & Yagan D. (2011). How does your kindergarten classroom affect your earnings? Evidence from Project STAR. Quarterly Journal of Economics, 126(4), 1593-1660. http://obs.rc.fas.harvard.edu/chetty/STAR.pdf

In a separate analysis, Alan Krueger, Chair of the Council of Economic Advisers, estimated that every dollar invested in reducing class sizes yielded about $2 in long term economic benefits. https://etec511.wikispaces.com/file/view/economic+considerations+and+class+size.pdf

Smaller Classes Lead to More Successful Students

Wealthy private schools understand the importance of small class size. For example, at Lakeside Private School in Seattle, average class sizes are 16 students. If class sizes of 16 students is considered ideal for the children of the wealthy, small class sizes of 16 students should be available to all students in Washington state.

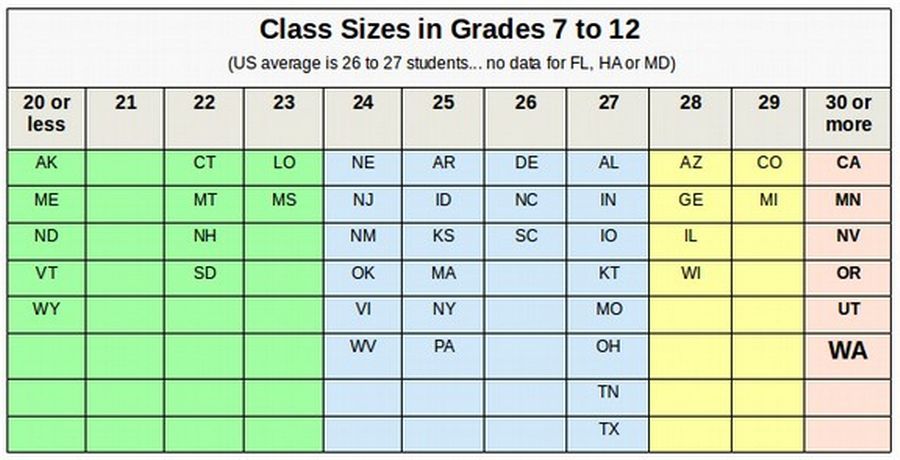

Sadly, Washington has among the highest class sizes in the nation. According to the National Center for Education Statistics, in the 2020 -2021 school year, Washington State had the second highest class sizes in the nation for elementary school (28) and second highest class sizes in the nation for middle school (28). Actual class sizes are much higher as the results include special ed classes that might be only a couple of students.

https://nces.ed.gov/surveys/ntps/estable/table/ntps/ntps2021_sflt07_t1s

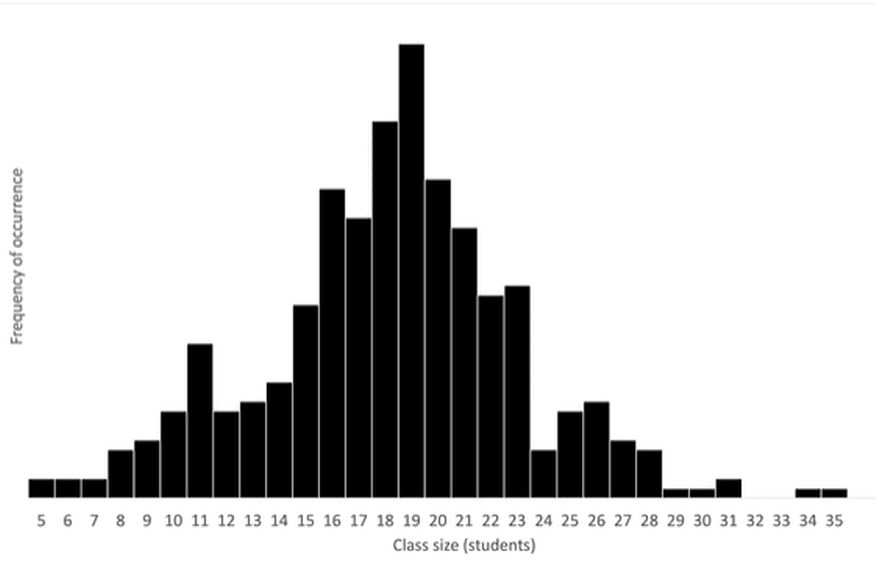

This estimate of class sizes comes from a national survey of classroom teachers in which teachers are asked how many students are in their average classroom. Here is a 2020-2021 study on the distribution of class sizes in the US:

According to the NCES National Teacher and Principal Survey, the average class size was 19 students. https://nces.ed.gov/surveys/ntps/tables_list.asp

Here is a distribution of class sizes showing which states have low, average, above average or extremely high class sizes:

However, even this survey of teachers under-reports the actual class sizes in the nation and in Washington state because it includes Special Education teachers who often have classes of under 10 students. Excluding Special Education classes, the typical or median class size in Washington state is close to 32 students per teacher per class period.

Why Actual Class Sizes are Much Larger Than Student to Teacher Ratios

The most common mistake made when discussing class size is to confuse class sizes with Student to Teacher Ratios. The Student to Teacher Ratio is determined by dividing the total number of students in a school or a state by the total number of professional staff at the school or the state. For example, if you go to the Washington State OSPI website and click on Policy and Funding, then School Apportionment, then School Publications, then Personnel Summary Reports, then select a year, then click on Table 46, (which currently is on page 419), you will get a report called “Ratio of Students to Classrooms.” This is actually the Student to Teacher Ratio. For the 2023 -2024 school year, this ratio was 17 students per teacher. https://ospi.k12.wa.us/sites/default/files/2024-02/allpersonnelsummaryreport2023-24.pdf

This type of statistic might mislead one into believing that the class sizes in Washington state are only 17 students – which would mean Washington state has the lowest class sizes in the nation. Yet if you walk into any real classroom at any real school in Washington state and count the actual students, you will see about 30 students in the real classroom. Many classrooms have 35 to even 40 students!

Why is there such a huge difference between the Student to Teacher ratio reported by OSPI and the number of students in real classrooms? The problem is that OSPI uses an extremely broad definition for classroom teacher. Many so-called classroom teachers are actually administrators. We need administrators. But we should not be misleading parents and voters by calling them teachers. Using Student to Teacher ratios misleads the public and even legislators into thinking that class sizes are not that bad when the truth is that class sizes in Washington state are among the highest in the nation.

In fact, using a real average class size of 30 students, the actual number of classroom teachers we have is about 36,000. This means that OSPI is mis-reporting 24,000 administrators as teachers. This also means that at 10,000 additional teachers per billion dollars, it would take about $3 billion dollars per year to reduce class sizes to the national average here in Washington state.

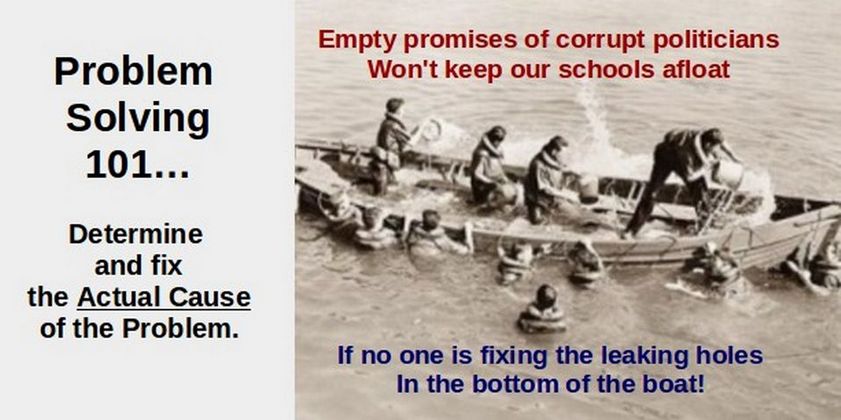

Where can we get $3 billion per year needed to cut class sizes in Washington state to the national average? A more accurate question is where are the money went that should have gone to our public schools?

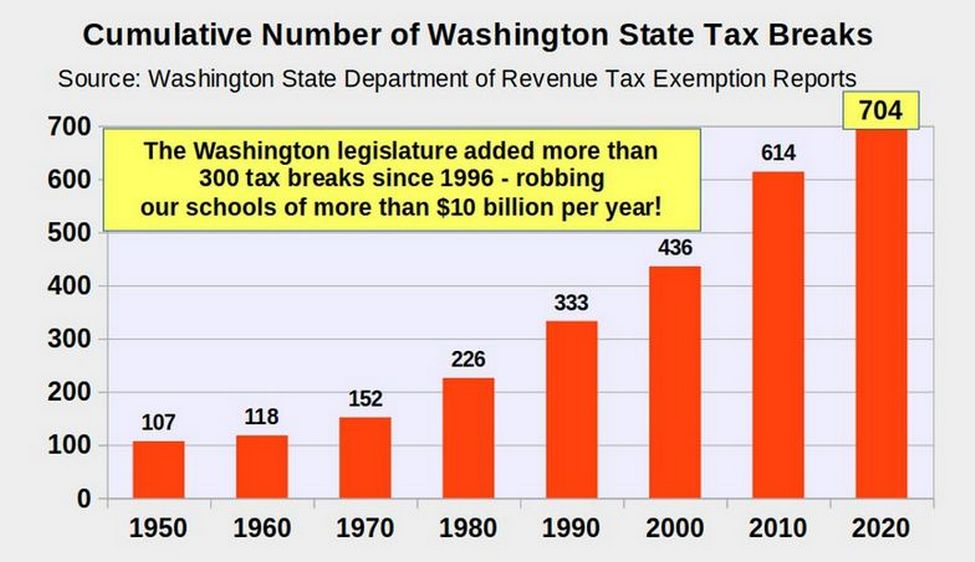

It turns out that there is no need to increase taxes at all. What we really need to do is decrease tax breaks for wealthy corporations. It will be impossible to lower class sizes for struggling students until we first recognize and better understand how Washington legislators real Paramount Duty has not been our public schools but rather giving away more than $36 billion in tax breaks to wealthy multinational corporations (who pay for their re-elections). Here is a graph of the increase in the number of state tax breaks since 1996:

This is why we now have huge class sizes, unfair property taxes and a broken school funding system. It should be obvious that giving away tens of billions of dollars in tax breaks every year conflicts with the Paramount Duty of the legislature to fully fund our public schools. Every billion dollars of tax exemptions means 10,000 more teachers losing their jobs and thousands of kids forced to endure higher class sizes. This fact is not mentioned on any of the tax break reports.

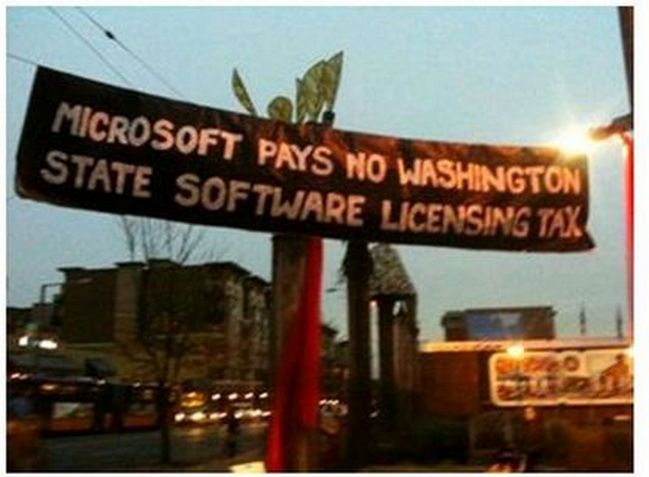

An Example of an Illegal Corporate Tax Break: Microsoft

Microsoft gets a Washington state tax break of about a billion dollars a year. The Microsoft Tax break is letting Microsoft pretend they are located in Reno Nevada instead of Redmond Washington.

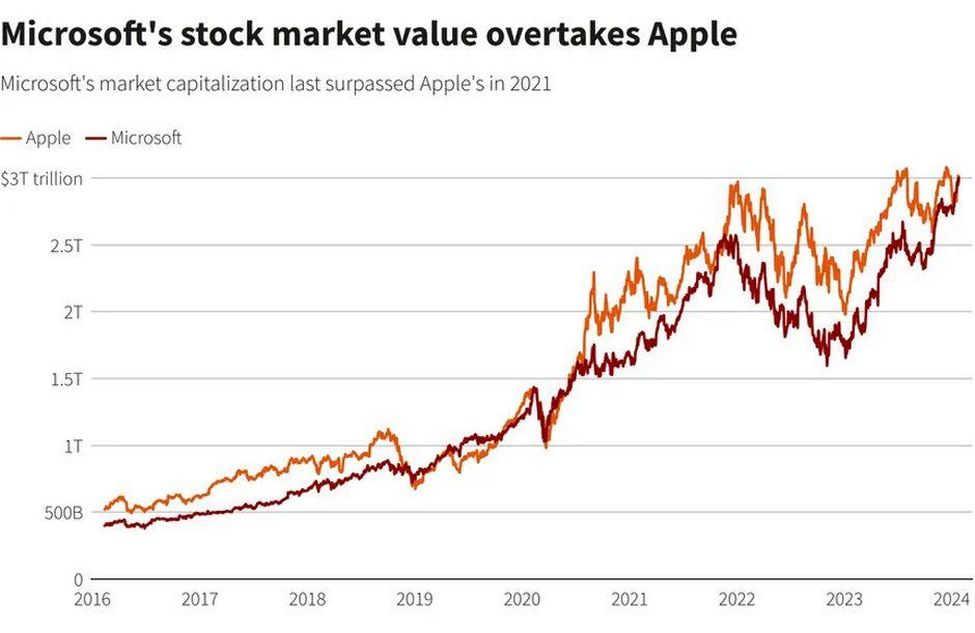

The actual location of Microsoft is Redmond, Washington – and the location of their server farm is in Quincy Washington. So the real reason property taxes were jacked up on homeowners in King and Snohomish counties was to protect billions of dollars in tax breaks for the richest corporation in the history of the world. Is there anyone who actually believes that a corporation worth THREE TRILLION dollars can not afford to pay their fair share of state taxes?

The Microsoft tax break is only one of 700 tax breaks that rob the rest of us tax payers of about $30 billion per year. All of these tax breaks are illegal because they violate several sections of our State Constitution.

Corporate Tax Breaks do NOT create jobs!

The Department of Revenue currently collects about $20 billion per year in taxes but also exempts at least $30 billion per year in state taxes. The DOR Tax Exemption Study attempts to describe the $30 billion per year in lost state revenue. These $30 billion in lost state revenue are "justified" by corrupt state legislators with the false claim that they "create jobs." In fact, history shows that in nearly every case, tax exemptions to wealthy multinational corporations like Microsoft and Boeing do not create jobs. For example, after receiving billions in tax breaks, Boeing has laid off thousands of workers. Microsoft used their tax breaks to build sweat shops in China - also firing thousands of Washington workers.

Why Tax Breaks are Prohibited by our State Constitution

In 1889, the 75 delegates who drafted our State Constitution were determined to see to it that the State provided ample funding for our public schools. This was why they put into our State Constitution a clause making it the Paramount Duty of the State to amply fund our schools. In fact, the Washington State Constitution is the only constitution in the nation to make it the Paramount Duty of the entire State to amply fund our public schools.

Does our Supreme Court have the power to repeal tax breaks?

Our State Constitution has several clauses prohibiting the legislature from granting tax breaks to private corporations. The problem with granting 700 tax breaks to wealthy corporations, besides the fact that these billions in tax breaks make it impossible to fully fund our schools, is that these tax breaks create a non-uniform system of taxes whereby local homeowners pay a much higher percentage of taxes than wealthy multinational corporations. Put another way, even if the legislature had fully complied with their Paramount Duty to amply fund our public schools, tax breaks to wealthy corporations would still be against the Washington State Constitution. Throughout the State Constitution, there are several clauses to prohibit granting tax breaks to private corporations. Here are three of those clauses.

Article 2, SECTION 28 SPECIAL LEGISLATION. The legislature is prohibited from enacting any private or special laws... Here are three of several clauses prohibiting tax breaks to corporations:

5. For assessment or collection of taxes, or for extending the time for collection thereof.

6. For granting corporate powers or privileges.

10. Releasing or extinguishing in whole or in part, the indebtedness, liability or other obligation, of any person, or corporation to this state.

Every tax break passed by the Washington legislature is a clear violation of Article 2, Section 28 of our State Constitution. Despite this fact, no other state in the nation grants tax breaks to wealthy corporations to the extent that the Washington legislature has granted tax breaks to wealthy corporations. The total is now more than $30 billion per year. In granting 700 tax exemptions, some of which apply to only a single corporation, such as Microsoft or Boeing, our state legislature has created laws that clearly violate the uniformity clause of Article 7, Section 1 of our State Constitution. These special tax breaks are not legal even if the Constitution did not have a Paramount Duty clause. But when we also consider the Paramount Duty clause and how hard the drafters of our State Constitution worked to prevent corporate corruption in our state, the existence of these 700 illegal tax breaks adds insult to injury.

Even after our Supreme Court ruled in 2012 that our public schools were not being amply funded (something obvious to any parent or teacher), the legislature continued to enact even more tax breaks - including a new $9 billion tax break for Boeing that was the largest tax break in the history of the planet. In January 2012, just weeks after our Supreme Court found that the legislature had failed meet their Constitutional duty to fund the public schools the legislature renewed $2.2 billion in corporate tax breaks – in a single afternoon!

Our State Constitution was written by people who deeply feared that a corrupt legislature would refuse to fund our public schools. So they put several clauses in our State Constitution specifically to take power AWAY from the legislature and put it in the hands of independently elected people with the hope that they would force the legislature to fund our schools. This is exactly where we are today.

Here is a quote from the McCleary Plaintiff’s brief: “The State’s putting tax exemptions for the private sector ahead of funding for public schools is not new. For example, after this Court’s January 2012 decision made the meaning of the State’s “paramount duty” unequivocally clear, the 2013 legislature focused instead on a special session to give an airplane company a multi-billion dollar tax break. All told, the State’s recent tax exemption study reported that 694 of the tax exemptions handed out by the State totaled $50.4 billion in the 2015-2017 biennium – with 114 of those exemptions enacted after the January 2007 filing of this suit. The State’s paramount constitutional duty is ample K-12 funding – not tax exemptions… “

We will never be able to fully restore school funding until we get rid of these dishonest and illegal tax breaks. We cannot allow our legislature to give away more than $25 billion per year in tax breaks for wealthy corporations and still have enough money left to fully fund our schools and lower class sizes. In addition to restoring local control of schools, we should work to repeal the massive tax breaks. The result will be that local property taxes on home owners can be cut in half – back to what they were 10 years ago. This is our pledge to home owners. We will hold the legislature’s feet to the fire – to cut the property tax burden on local home owners in half by insisting that the legislature repeal billions in illegal tax breaks they currently give to billionaires and wealthy corporations.

Conclusion: The Future of our Schools is in Your Hands

It is time to end corrupt corporate tax exemption bribes and kickbacks in Olympia. The time has come to end this corruption in Olympia. We need to inform every parent and every teacher in our State about the drawbacks of the Levy Swipe Scam. The first step is to share this article with other parents and teachers. Email it to friends and bring it up at your local PTA meeting. Hold a discussion on school funding at your local library. It is time to stop hoping that someone else will solve this problem. The future of our kids and our schools is up to everyone of us to take direct action now.

As always, I look forward to your questions and comments!

Regards,

David Spring M. Ed.

Director, Washington Parents Network.com