Welcome to our Washington Common Sense Coalition! We are a coalition of citizens who believe that Washington is currently going in the wrong direction. Our goal is to restore a government based on Common Sense and honoring our Washington State Constitution. If you agree it is time to change course, then we encourage you to join us! Together we can end the insane policies currently destroying our schools, our jobs and our economy and bring a new day of prosperity and Common Sense policies to Washington state.

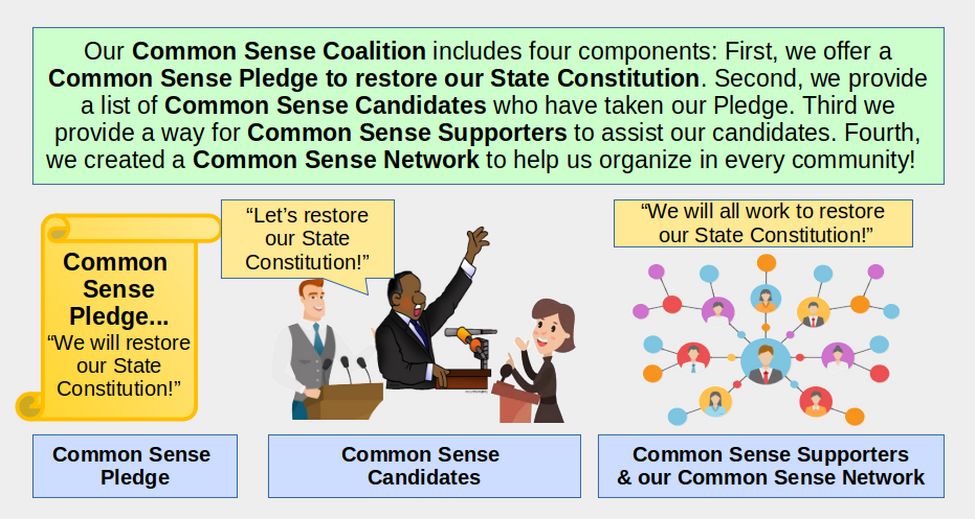

Our Common Sense Coalition includes the following four components:

First, we offer a Common Sense Pledge to Restore our Washington State Constitution. This includes a list of 10 sections where our State Constitution has been violated and steps needed to restore these sections of our State Constitution.

Second, we provide a list of Common Sense Candidates running in Washington State in 2024 who have taken our Common Sense Pledge. If you are a candidate, we hope you will read and publicly support our pledge.

Third, we provide a list of Common Sense Supporters who have taken our Pledge. We encourage our supporters to support our Common Sense candidates and pass one of more of our Common Sense Resolutions in your local community. We intend to use these resolutions to create a critical mass to restore Common Sense to our schools, our legislature and our economy.

Fourth, we have created a Common Sense Network which is our own social network to help our candidates and supporters organize in their own local community. More on how you can join our Common Sense Network in the coming weeks.

Thank you for helping us promote and build our Common Sense Coalition in your community. Together we can end the insane policies currently destroying our schools, our jobs and our economy and bring a new day of prosperity and Common Sense policies to Washington state. Below we explain some of the problems that have led us to create our Common Sense Coalition. We hope you will share this information with your friends and neighbors.

How 20 years of ignoring our State Constitution has led to disaster

In 1889, 75 delegates from around Washington State were elected to draft our State Constitution:

The thing these delegates feared most was a corrupt legislature and a corrupt Governor. They therefore wrote our State Constitution with many clauses to limit the power of the Legislature and Governor. Here is a quote from a local newspaper in 1889: "If a stranger dropped into the convention, he would conclude that the members were fighting a great enemy - and that this enemy is the State legislature!" Tacoma Daily Ledger August 9 1889

To prevent the legislature from being corrupted by wealthy corporations, the delegates put a clause in our State Constitution making it a crime to bribe elected officials.

Article 2, Section 30 BRIBERY OR CORRUPT SOLICITATION states: “The offense of corrupt solicitation of members of the legislature, or of public officers of the state... to influence their official action, shall be defined by law, and shall be punished by fine and imprisonment.”

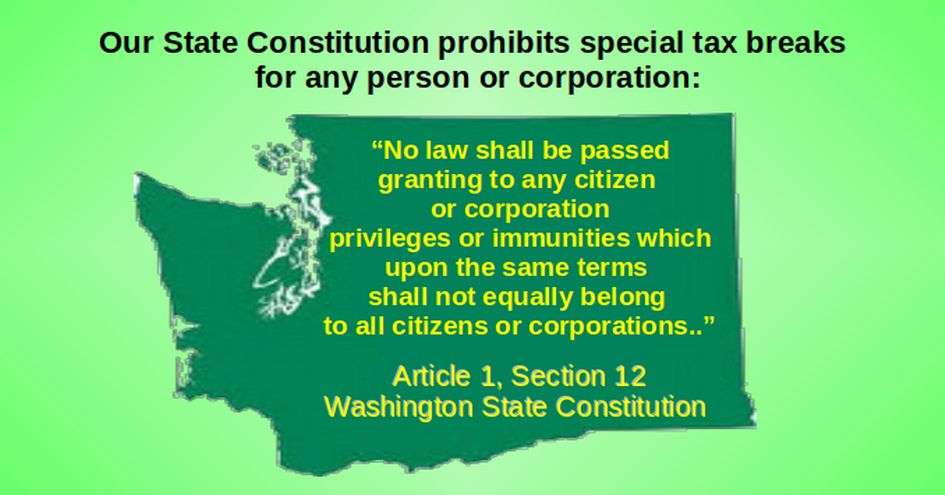

The drafters of our State Constitution also wanted to prevent bribery and kickback schemes where corporations would pay to elect corrupt candidates who would then grant special tax breaks for the corporations that elected them. To prevent this, they added Article 1, Section 12 which states: “No law shall be passed granting to any citizen or corporation privileges or immunities which upon the same terms shall not equally belong to all citizens or corporations..”

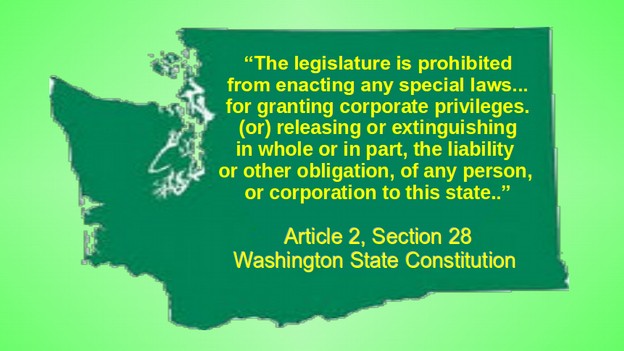

They also added Article 2, SECTION 28 SPECIAL LEGISLATION which states: “The legislature is prohibited from enacting any private or special laws...”

Here are three of several clauses prohibiting tax breaks to corporations:

5. For assessment or collection of taxes, or for extending the time for collection thereof.

6. For granting corporate powers or privileges.

10. Releasing or extinguishing in whole or in part, the indebtedness, liability or other obligation, of any person, or corporation to this state.

The primary obligation every corporation has to the State is to pay State taxes just like the rest of us do. Therefore, granting wealthy corporations special corporate tax breaks is clearly against our State Constitution.

To make this issue perfectly clear, the drafters of our State Constitution also put in a clause requiring a uniform system of State taxes:

Article 7, Section 1 TAXATION states: “The power of taxation shall never be suspended, surrendered or contracted away. All taxes shall be uniform upon the same class of property... and shall be levied and collected for public purposes only.”

In addition, to prevent wealthy corporations from buying elections, the drafters put a clause in our State Constitution requiring that all elections in our State be free and equal. Article 1, Section 19 ELECTIONS states: “All Elections shall be free and equal.”

The words Free and Equal means that all candidates should be treated equally. It is against our State Constitution for corporations that control the corporate media to spend millions of dollars promoting their preferred candidates with dozens of puff articles while attacking any candidates who dare to challenge their preferred candidates.

Over time, despite these “Honest Government” provisions in our State Constitution, rather than being free and equal, our elections have become little more than a bidding war where corporations and billionaires spend mountains of money electing politicians willing to do their bidding.

Today, elections are almost always won by the candidates who raise the most money and are therefore able to buy the most recognition from the corporate controlled media. We voters have failed to realize that the candidates who raise the most money are also likely to be the most corrupt.

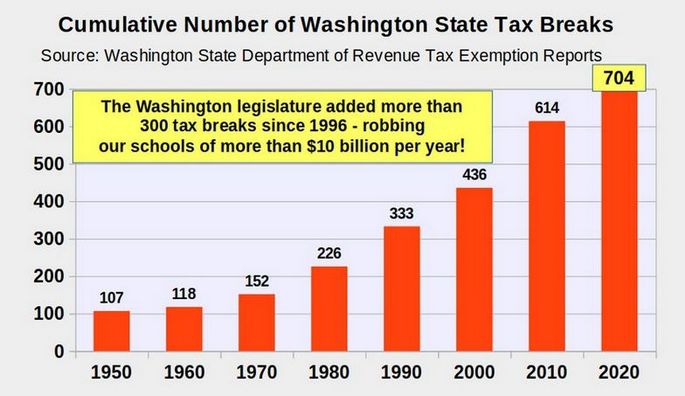

Sadly, the Washington legislature has granted more than 700 tax breaks to wealthy corporations. This is more than any other State in the nation. In short, Washington now has the most corrupt legislature in the nation.

The total amount of lost tax revenue from these 700 exemptions is now more than $25 billion per year. In granting 700 tax exemptions, some of which apply to only a single corporation, such as Microsoft or Boeing, the legislature has not forced the rest of us to pay higher taxes, but they have incentivized the most corruption election system in the nation.

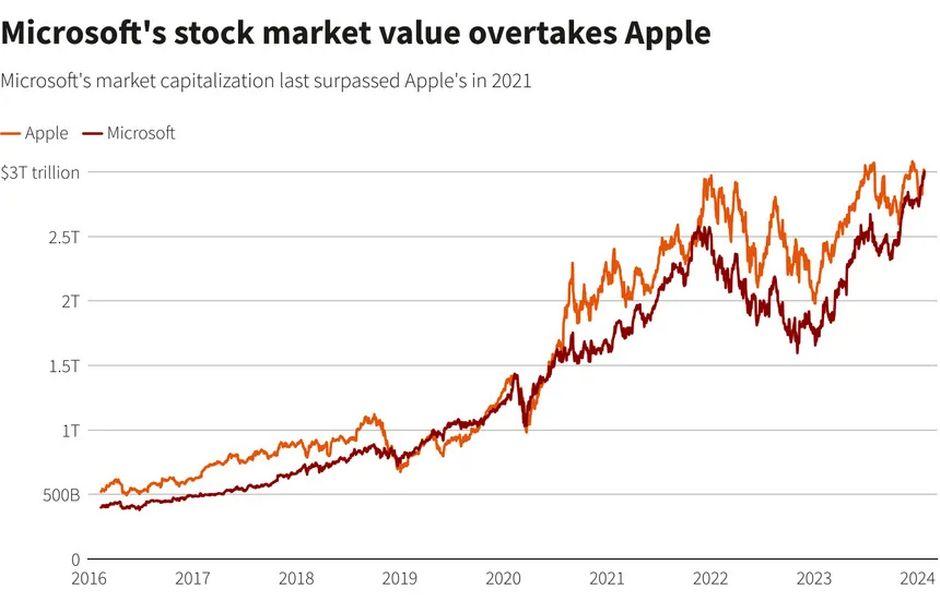

Here we will look at one of the biggest tax breaks called the Microsoft tax break. The Microsoft Tax break lets Microsoft avoid paying about a billion dollars a year in State taxes by pretending they are located in Reno Nevada instead of Redmond Washington.

It is ridiculous to claim that Microsoft can not afford to pay State taxes or that they will decide to leave our State if they have to pay taxes. This claim ignores the fact that Microsoft is the richest corporation in the history of the world. They are now worth more than three TRILLION dollars and make hundreds of billions of dollars a year off their server farm in Quincy Washington – which has the additional benefit of being given cheap hydroelectric power from our dams on the Columbian River.

Is there anyone who actually believes that a corporation worth THREE TRILLION dollars can not afford to pay their fair share of state taxes?

Why Corporate Tax Breaks are a Crime Against our Children

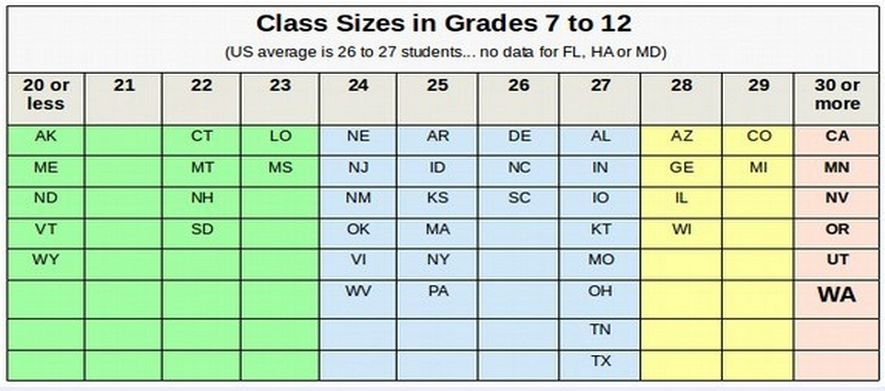

To pay for these corporate tax breaks, the legislature failed to provide school districts with the funds needed to hire more teachers to keep up with increasing enrollments. As a consequence, over time, class sizes in Washington state increased to among the highest in the nation.

As a consequence of having the highest number of corporate tax breaks in the nation, our kids were (and still are) forced to deal with the highest class sizes in the nation. In 2011, the average class size in Washington state was nearly 30 students. Here is a distribution of class sizes showing which states have low, average, above average or extremely high class sizes: https://nces.ed.gov/programs/digest/d13/tables/dt13_209.30.asp

The problem with high class sizes is that struggling students do not get the help they need and teachers suffer from nervous breakdowns:

Tax Breaks for Wealthy Corporations are also a Crime Against our Teachers

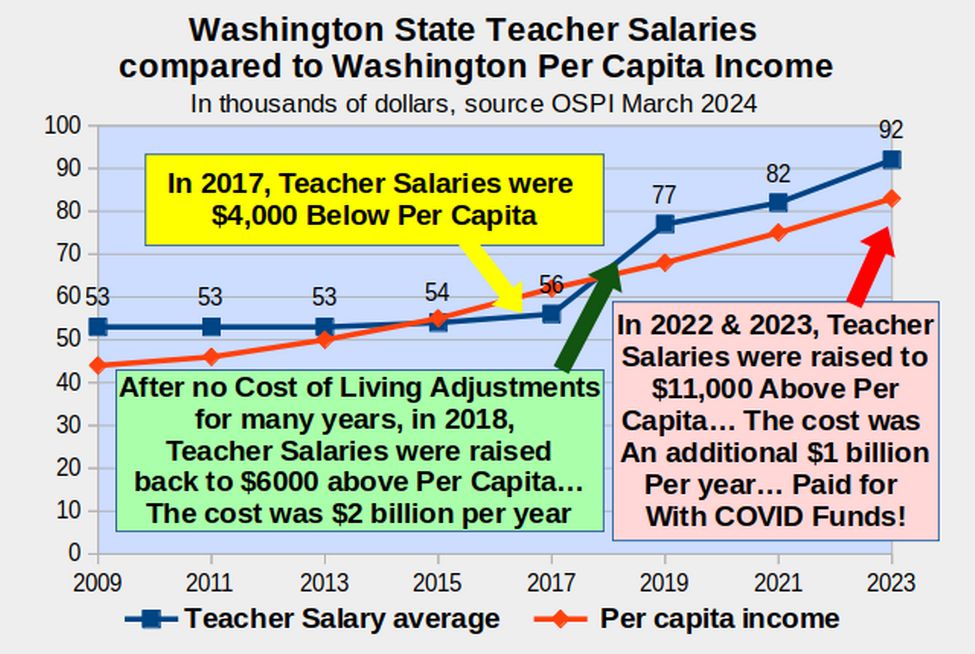

The second groups of victims that have suffered for years as a result of the billions in illegal tax breaks for wealthy corporations has been our teachers. Historical, our teachers have on average been paid about 10% above the Washington State Per Capita Income in recognition that our teachers have Advanced Degrees. In addition, each year, our teachers were given a Cost of Living Adjustment, called a COLA, to adjust for the Inflation rate. However, due to giving away billions of dollars in illegal tax breaks, there was not enough money left in the State Budget to pay the COLA. So year after year, teachers went without a COLA adjustment. By 2017, this dropped teacher pay to $4,000 below the Per Capita Income when it should have been $6,000 (or about 10%) above the Per Capita income. The loss of income for each teacher was about $10,000 per year.

Source: Pages 17 and 18 Tables 1 and 2 in this link:

https://ospi.k12.wa.us/sites/default/files/2024-02/allpersonnelsummaryreport2023-24.pdf

Please note that the above table refers to the average teacher salary. The beginning teacher salary is about $12,000 per year less than the average salary and it takes about 5 years to reach the average salary. This recognizes the fact that it takes about 5 years of experience for a teacher to become a truly effective teacher. At the same time, teachers with more than 10 years of experience are typically paid $12,000 above the average salary shown above.

In June 2017, the legislature passed the Levy Swipe Bill (House Bill 2242) which they claimed would raise school funding by $2 billion – but the Levy Swipe did not actually increase school funding because it merely took $2 billion in Local Levy funds and called them State funds. However, because 2018 was the “double taxation” year, with both the new high state levy and the old high local levies, there was temporarily $2 billion extra to bring teacher pay up to $6000 above the Per Capita income in 2018 and 2019.

Tax Breaks for Wealthy Corporations are also a Crime Against Homeowners

This return to $6000 above Per Capita income for teachers ended the McCleary lawsuit in 2018 – but led to monstrous increase in property taxes - mainly in King and Snohomish counties. Now it was not teachers who were paying for the billions of dollars in illegal tax breaks to wealthy corporations – it was homeowners in King and Snohomish counties!

The cost was $2,000 to $3,000 per year in additional housing costs that were already far too high. Rents also went up dramatically as landlords passed on these property tax increases. So renters also paid for the Levy Swipe – which was therefore a factor that increased homelessness in King and Snohomish counties. But the real problem was that there was no actual increase in school funding other than Levy Swipe property tax scam.

This Ticking Time Bomb remained hidden for the 2020-21 school year as $1.4 billion in one time emergency federal funds kicked in. Had the COVID funds not magically appeared, there would have been a $1.4 billion school funding shortfall that year. As it was, the COVID funds were just enough to hide the fact that the Levy Swipe was a scam for one more year.

An Unwise and Unsustainable Raise in Teacher Pay in 2022 & 23

The truth about the Levy Swipe began to come out in the 2021-22 school year when COVID funding fell by $200 million to just $1.2 billion per year which forced school districts to make $200 million in cuts.

In May 2022, school districts were hit by a Double Whammy. COVID funding fell by another $400 million to just $800 million per year. But to add insult to injury, the 2022 legislature passed a Teacher Cost of Living adjustment that was far above the increase in Per Capita income (look closely at the chart above to see this). This unwise pay increase cost school districts another $500 million and the combination of declining COVID funds and rising teacher pay, forced school districts to fire thousands of teachers – and thereby increasing class sizes.

In May 2023, another Double Whammy occurred with COVID funding falling another $400 million to $400 million and the 2023 legislature again passing a a Teacher Pay increase that was far above the Per Capita income (look closely at the chart above to see this). This unwise pay increase cost school districts another $400 million. The combination of declining COVID funds and rising teacher pay, forced school districts to fire thousands of additional teachers – and thereby increase class sizes even more.

In May, 2024, federal COVID funds will drop another $400 million to ZERO. For the first time since 2017, school districts will finally be forced to deal with the reality of the Levy Swipe. They will therefore have to fire thousands of additional teachers and thereby increase class sizes even more.

There is only one solution that will actually solve the School Funding and Property Tax Crisis. The solution is to honor our State Constitution and end the illegal tax breaks for wealthy corporations. This will generate billions of dollars which wealthy corporations can simply deduct from their federal taxes. We can then use these billions of dollars to roll back property taxes, rehire the thousands of teachers that have been fired and reduce class sizes down to the national average.

The obstacle to this solution is that many current legislators are more interested in protecting tax breaks for wealthy corporations than they are in honoring our State Constitution. It will therefore require all of us working together to elect candidates who are fully committed to restoring and upholding our State Constitution. This is our goal in creating our Common Sense Coalition. We hope you will join us!

Note: There are many other areas of our State Constitution that are being violated. We will be reviewing these issues in future articles